|

IN BRIEF

|

Online scams have become increasingly sophisticated, making it essential for individuals to recognize the warning signs that indicate potential fraud. Common indicators include unexpected contact from someone claiming to represent a government agency, a financial institution, or even a family member demanding payment. Additionally, scammers often create a sense of urgency, threatening dire consequences if their requests aren’t met immediately. By staying aware of these red flags and adopting a cautious approach, you can better protect yourself from falling victim to online fraud and ensure that your personal information remains secure.

Recognizing the warning signs of online scams is crucial for protecting yourself and your sensitive information. Scammers often employ various tactics to deceive their targets. Knowing what to look for can help you avoid falling victim to these schemes. Let’s explore the advantage and disadvantages of being aware of online scam warning signs.

Advantages

One significant advantage of understanding the warning signs of online scams is enhanced vigilance. When you know what red flags to watch for, you can better protect your financial resources and personal information. For instance, if someone claims to be from a government agency or well-known institution and demands urgent payment, you can recognize this as a potential scam.

Another benefit is the peace of mind that comes with being informed. Awareness of common scams—such as phishing attempts or lottery frauds—allows you to proactively defend against possible threats. This knowledge empowers you to ask critical questions, evaluate the credibility of the source, and avoid making hasty decisions. Furthermore, resources such as FTC articles provide guidance on avoiding scams and recognizing red flags.

Disadvantages

Despite the benefits, there are also challenges associated with identifying warning signs of scams. One major disadvantage is the overwhelming number of fraudulent schemes that continue to evolve. Scammers are skilled at altering their tactics, making it increasingly difficult to keep up with their methods. For instance, the same scammers may switch from traditional phishing emails to more sophisticated approaches that combine social engineering techniques.

Moreover, the pressure and urgency often created by scammers can lead to feeling anxious or panicked. This emotional manipulation can cloud judgment, even for seasoned individuals aware of the warning signs. When developed scenarios involve threats of losing a prize or a loved one in danger, it becomes challenging to maintain rational thinking. Resources about phishing scams can help you recognize these tactics, but it may still be tricky to discern the truth amidst the fear.

Lastly, while awareness is beneficial, it can also lead to what is known as information fatigue. As more scams become publicized, individuals may start to feel cynical or overwhelmed by the constant influx of advice. This may result in ignoring legitimate communications or feeling unsure of who to trust. To navigate safely, consider utilizing resources like Wells Fargo’s online shopping scam guide which provides clarity amidst the noise.

Online scams are becoming increasingly sophisticated, making it crucial to recognize warning signs that might indicate fraud. This article will guide you through the common red flags to look out for when navigating the digital landscape, ensuring you can protect yourself and your personal information.

Common Signs of an Online Scam

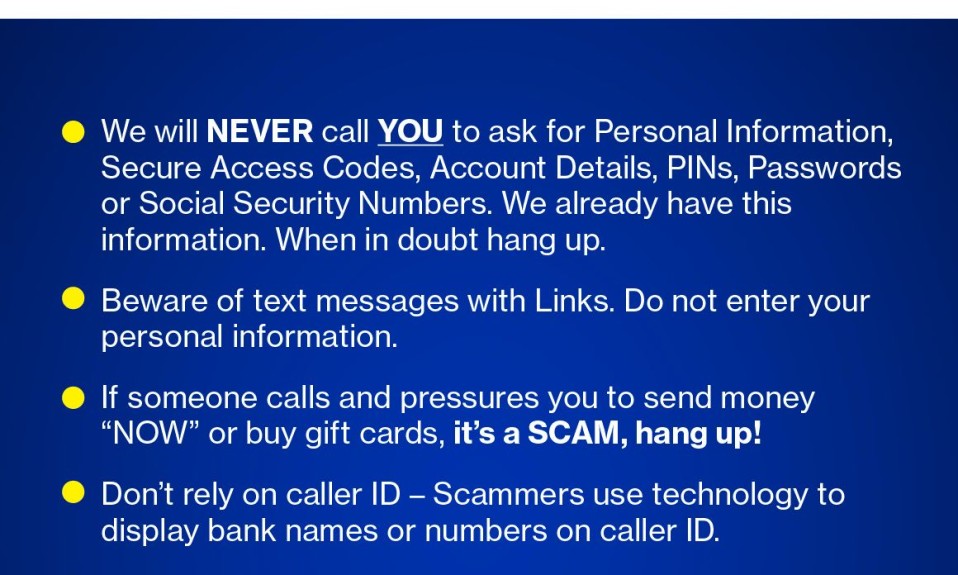

One of the first warning signs to notice is when you receive unsolicited communication from someone claiming to be from a reputable organization, such as a government agency or a bank. They may ask you to provide personal information or request a payment. Always question unsolicited requests and verify their authenticity before proceeding.

Urgency and Pressure

Scammers often create a sense of urgency by claiming that you must act immediately to receive a prize or to resolve an issue. This tactic is designed to overwhelm you and provoke hasty decisions. Be cautious of any communication that insists you need to respond without delay; it could be a sign of a scam.

Too Good to Be True Offers

Another significant red flag is when you encounter offers that seem too good to be true. This can manifest as products advertised at extremely low prices or services with extraordinary benefits. Such deals often lure victims into traps, so it’s essential to conduct thorough research before making any commitments.

Emotional Manipulation

Scammers frequently prey on your emotions. They may pose as someone in distress, claiming that a friend or family member is in trouble abroad and urgently needs money. This emotional approach can cloud judgment, so stay vigilant and verify the claims independently.

Identifying Suspicious Websites

When shopping online, be on the lookout for subtle indicators that a website might be fraudulent. For instance, check for spelling errors in the URL, an overly complicated design, or a lack of secure payment options. Such discrepancies can be initial signs of a scam site.

Protecting Yourself from Scams

To stay safe while online, remember these vital strategies: stop immediately if you feel unsure about a request for money or personal information; check the message’s legitimacy by researching the organization; and protect your data by only sharing sensitive information with trusted sources.

For more detailed guidance on identifying and reporting scams, consider visiting resources like Online Scams or review common red flags at Georgia Attorney General’s Consumer Protection.

In the growing digital landscape, online scams have become increasingly sophisticated. Recognizing the warning signs is crucial to safeguarding yourself from falling victim. This article explores common indicators of potential scams and offers guidance on how to protect your personal information and finances.

Unsolicited Communication

A prevalent red flag is receiving unexpected contact from someone claiming to be from a reputable organization, such as a bank or the government. If they ask for money or personal information, it’s wise to be skeptical. Always verify their identity through official channels before proceeding.

Create a Sense of Urgency

Scammers often instill a sense of urgency, warning that immediate action is required to claim a prize or assist a distressed relative abroad. This tactic aims to pressure you into making hasty decisions without proper consideration. Always take a moment to reassess such claims.

Too Good to Be True Offers

Be cautious of deals that seem exceptionally beneficial. If a product is advertised at a price that appears unbelievably low or promotes outrageous features, it may indicate a scam. Trust your instincts and conduct thorough research before making any purchases.

Request for Personal or Financial Information

Legitimate companies rarely ask for sensitive information through email or phone calls. If someone pressures you to provide such details, it’s likely a scam. You can find more details on classic warning signs of potential fraud on the Consumer Finance website.

Spelling Errors and Poor Grammar

Many scam communications contain spelling errors and awkward phrasing, which can be an indicator of their illegitimacy. Be attentive to the quality of the correspondence; if it seems unprofessional, treat it with caution.

Lack of Contact Information

A reputable business will provide clear contact details, including address and phone number. If the contact information is missing or presents inconsistencies, this could signal a scam. Always exercise due diligence before engaging in any transaction.

Pressure to Use Specific Payment Methods

Scammers typically insist on non-traditional payment methods, such as wire transfers or services like Zelle and Venmo. If someone is pressuring you to use these platforms, consider it a significant red flag.

Check for Warning Signs on the Web

Your web browser can be a valuable tool in detecting scams. Modern browsers often come equipped with features that provide alerts about dangerous or deceptive websites. Pay attention to these warnings, as they can help you navigate safely online.

Reporting Scams

If you suspect you are interacting with a scam, it is essential to report it to the appropriate authorities. Websites dedicated to tracking online scams can offer additional guidance and support. You can learn more about recognizing different types of online scams by visiting this resource.

Warning Signs of Online Scams

| Warning Signs | Description |

| Unsolicited Contact | Receiving unexpected messages from unfamiliar sources claiming to be authorities. |

| Pressure to Act Quickly | An urgent request to respond or pay money to avoid losing a prize or helping a relative. |

| Atypical Payment Methods | Being asked to use unusual payment apps for transactions. |

| Too Good to Be True Offers | Items sold at prices significantly lower than market value. |

| Spelling and Grammatical Errors | Noticing frequent mistakes in messages or websites, which may indicate a scam. |

| Lack of Contact Information | Website or seller providing minimal or no means of reaching them. |

| Unverified Websites | Websites with little information or new domains should raise suspicion. |

Warning Signs of Online Scams

Recognizing the warning signs of online scams can help protect yourself and your finances. One classic indicator is when a stranger claims to be from a trusted organization, such as the government or a bank, and requests immediate payment. This tactic is often designed to exploit your trust and push you into a hasty decision.

Another red flag is the creation of a sense of urgency. Scammers might pressure you by saying you must act quickly to claim a prize or help a family member in distress. This tactic plays on your emotions and can make it difficult to think clearly.

Unbelievably low prices can also signal a scam. If a product is advertised at a price that seems too good to be true, it’s essential to proceed with caution. Additionally, spelling errors or odd domain names in URLs can be an indication that the website is not legitimate.

Shopping online should always involve verifying information. If a seller pushes for immediate payment through unknown payment apps, it’s wise to be suspicious. Ensure that you are dealing with a reputable source before providing any personal information or financial details.

Always remember that if something feels off, it probably is. Take the time to check and validate any requests for money or personal data before engaging further. Protecting yourself online requires vigilance and a keen eye for potential scams.

In today’s digital age, online scams have become increasingly prevalent. Recognizing the warning signs of potential fraud is essential for safeguarding your personal information and finances. This article explores common indicators that you may be facing an online scam and provides guidance on how to stay safe while navigating the internet.

Recognizing Authority Abuse

One of the first things to look for is if the scammer uses authority to gain your trust. This could involve them pretending to be from a government agency, bank, or popular business. They often present themselves as someone with power, hoping you will act without questioning their motives.

Additionally, the communication may play on your emotions—scammers frequently create a personal connection to manipulate you. They might ask for help, claiming that a loved one is in urgent trouble. This emotional manipulation is a classic tactic used to prompt quick and irrational actions.

Urgency and Pressure Tactics

Be wary of messages or calls that create a sense of urgency. Scammers often insist that you must act immediately to prevent significant losses, like losing a prize or money owed. Such statements are usually red flags indicating a scam is at play.

Moreover, any form of pressure to make decisions quickly should raise suspicion. Legitimate organizations will not rush you into making choices without giving you time to think—an important factor to remember when dealing with unfamiliar communications.

Too Good to Be True Offers

Another common characteristic of scams is offers that sound astonishingly beneficial. This could be an extremely low price on a product or claims of high returns on investments. If something seems too good to be true, it probably is. Always conduct research and verify offers and claims before proceeding with any transaction or providing personal information.

Additionally, examine the website where the offer is posted. Look for spelling errors in the URL or the content—these could signify a fake website.

Unreliable Payment Methods

Many scammers will request payment via means that are difficult to trace. This includes instant payment apps like Zelle or Venmo, or pre-paid gift cards. If a seller insists on using these methods, it is a significant sign that you might be dealing with a scam.

Also, be cautious of sellers on platforms with little to no history or evidence of credibility. A lack of information about a business or individual can be a red flag indicating potential fraud. Always ensure you are transacting with reputable and well-reviewed sellers.

Online Communication Red Flags

When interacting with someone online, watch for signs that could indicate deception. For example, if you receive unsolicited messages from individuals claiming to have a strong connection to you or asserting that you’ve won a prize without entering a contest, you should be skeptical.

Additionally, if someone you are communicating with suddenly becomes threatening or aggressive when you express doubt or hesitation, it is a strong indication that you should disengage immediately.

Trust Your Instincts and Verify

Lastly, always trust your instincts. If something feels off or suspicious, take a step back. Think critically about the messages and interactions you encounter online. If necessary, confirm the legitimacy of a situation by reaching out to the organization directly through trusted channels.

Understanding the Warning Signs of Online Scams

In today’s digitally connected world, online scams have become increasingly prevalent, making it essential for individuals to recognize the warning signs. One of the most common indicators of a scam is a request for personal information or money from anyone claiming to represent a government, financial institution, or even a close friend in need of urgent assistance. Scammers often exploit emotions, creating a sense of urgency, pressuring victims to act quickly without fully considering the situation.

Another critical sign of a potential scam is the presence of unbelievably low prices or deals that sound too good to be true. These offers often lure victims into providing payment for products that either do not exist or are significantly inferior to what was promised. It’s also important to be wary of poorly written content, including spelling errors in URLs or communications that can indicate a lack of legitimacy.

Furthermore, scams frequently involve threatening language or claims of impending consequences that push individuals to comply with the request. Real organizations typically will not resort to intimidation tactics. Additionally, if contact originates from an unknown source and lacks verifiable credentials, it’s prudent to approach with caution.

To protect oneself from these deceptive practices, always verify sources and trust your instincts. If something feels off or if you are experiencing pressure to make a decision quickly, it may be a red flag. By educating ourselves on these common warning signs, we can safeguard our online experiences and reduce the risks associated with potential scams.